Skip Hire Sheffield – Rotherham – Barnsley

admin2024-04-26T11:09:29+00:00SHEFFIELD's No.1 , born and bred in Sheffield

Arthur's Skips & Waste Management Delivering the perfect sized skips for all your projects since 1994. Call Today: 0114 276 2425.

Serving South Yorkshire since 1994!

Full 2 weeks hire with every Skip delivered

Arthurs Skip Hire & Waste Management

100% RECYCLING

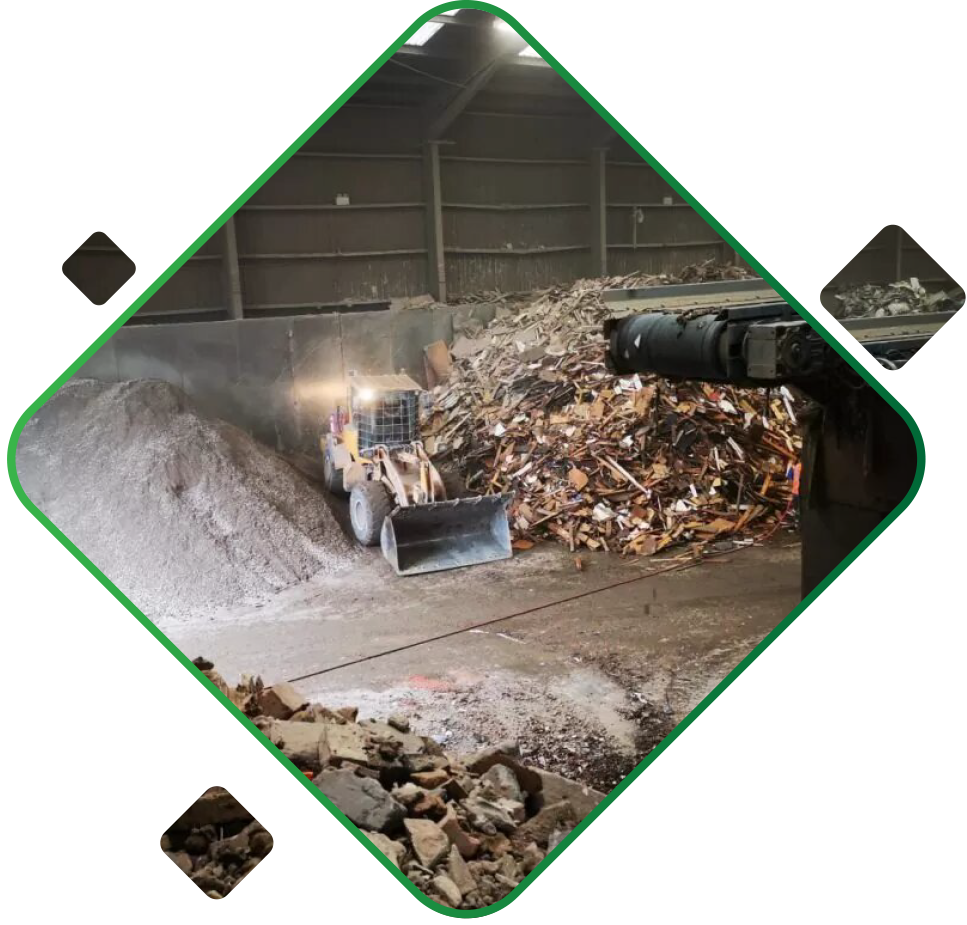

In the current climate, we all need to do more to be more environmentally friendly, recycling is one of the easiest things we can all do, Arthur’s is here to help with all your recycling needs and to help you do your bit for the environment too. Our processing procedure means we sort all the waste that we receive to ensure that it is recycled. We have installed the latest satellite navigation and computer software systems to assist our drivers & traffic team in supporting our clients with a prompt reliable service which in turn also makes Arthurs as a company more environmentally friendly.

- Fast, Safe & 2 Full Weeks Hire.

- 100% Recycled waste rating

- Hassle Free Delivery & Collection

- Certified, Licenced & Compliant.

- Recycling experience for 30 Years

- Sustainably Sourced Materials

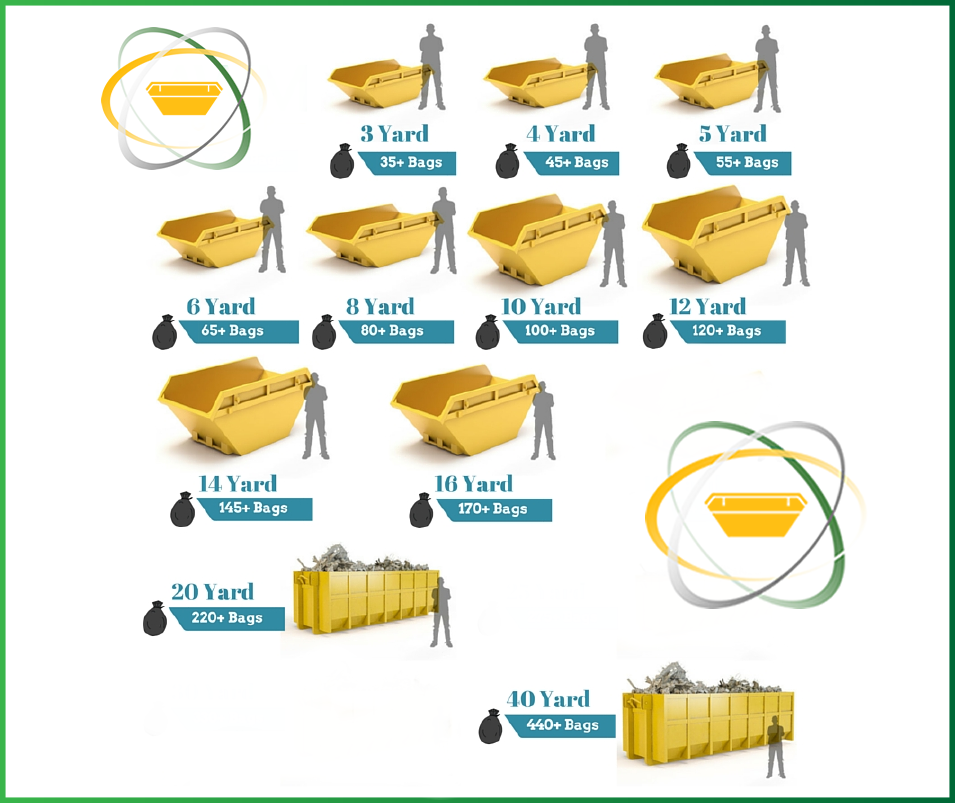

Arthurs Skip Hire Range

FULL RANGE OF SIZES

Made in SHEFFIELD in 1994. The Best UK Prices. Highest Quality Skips & Recycling rates. Safety compliance certificates. Skip tracking. Sustainable ECO friendly grab hire.

- Business waste management services keeping you on top of new standards.

- 3 to 40 ton Skips.

- Certified, Licenced & Compliant.

UNRIVALLED SERVICE

So, it pays to switch to Arthurs Waste Management - We have very competitive prices, 100% recycling rates and fast efficient delivery & collection. LOCAL COUNCILS REQUIRE YOU TO PURCHASE A PERMIT IF THE SKIP IS SITUATED ON A PUBLIC ROAD. We take all the hassle out of this by liaising on your behalf with the councils directly.

We can provide a Construction Waste Management Plan for the Site to use. In addition, we can provide monthly waste returns stating how much waste has been recycled. It should be noted that at present we are recycling waste in excess of 95%. Waste coded as 17-01 to 17-09 inclusive are 100% recycled. Waste information returned to the client is fully Compliant.

Our App allows you to sign into your dashboard and re-order skips in just one click, if you have regular skips hire needs!

UNRIVALLED SERVICE

So, it pays to switch to Arthurs Waste Management - We have very competitive prices, 100% recycling rates and fast efficient delivery & collection. LOCAL COUNCILS REQUIRE YOU TO PURCHASE A PERMIT IF THE SKIP IS SITUATED ON A PUBLIC ROAD. We take all the hassle out of this by liaising on your behalf with the councils directly.

We can provide a Construction Waste Management Plan for the Site to use. In addition, we can provide monthly waste returns stating how much waste has been recycled. It should be noted that at present we are recycling waste in excess of 95%. Waste coded as 17-01 to 17-09 inclusive are 100% recycled. Waste information returned to the client is fully Compliant.

Our App allows you to sign into your dashboard and re-order skips in just one click, if you have regular skips hire needs!

Arthurs Skip Hire & Waste Management

ARTHURS DELIVERED

Book today for a SPEEDY delivery! Your skip your way!

Watch how our skips are stored, delivered and collected. Our recycling plant, which is the biggest in the area.

Arthur's Skip Hire

HOT PRoducts

You can hire your perfect sized skip for a full 2 weeks using our online shop, or via the App. Do you order SKIPS regularly? We offer ONE CLICK re-ordering via the user dashboard..

ARTHURS WASTE MANAGEMENT FOR BUSINESSES

TESTIMONIALS

Arthurs Skips boosts recycling rates of all local skip hire companies who empty client skip contents at our waste recycling plant.

AWM increasing engagement and motivation in learning by raising awareness of recycling with local businesses.

Don't just take our word for it. Read some of our happy customers comments:

5 Star Skip Hire in and around South Yorkshire

Are you looking for skip hire around Sheffield, look no further! We offer a wide range of skip sizes to suit your waste recycling needs. Our service is professional, reliable, and affordable, and we are committed to recycling and diverting waste away from landfills.

At Arthurs Skip Hire, we have over 40 years of experience in the industry, and we have grown to become one of the most trusted waste management and skip hire companies in the area. Our skips are suitable for all types of domestic and commercial work, including garage clearance and garden waste removal.

Ordering a skip from us is easy – simply visit our website to book online, 24hrs a day, or get in touch with us on 0114 276 2425. We also offer a 2-week road permit at an additional cost if needed, and kindly ask that you fill our skips level to ensure safe transportation.

Please note that during busy periods, we recommend ordering your skip 2-3 days in advance to ensure availability. And as per your local council’s requirements, a permit is necessary if the skip is placed on a public road.

Don’t wait any longer, choose Arthurs Skip Hire for all your waste management needs today. Thank you for choosing our services, we look forward to helping you create a greener environment.